28/07/2011

Phusadee Arunmas

Bangkok Post

Thai rice exporters are already looking for alternative supplies from Vietnam and Cambodia in case the new government makes the price too dear for export, which could halve volume to only 5 million tonnes next year for a revenue loss of 60-70 billion baht.

The Thai Rice Exporters Association (TREA) has been crying foul for a while now regarding Pheu Thai’s announced policy to allow farmers to mortgage their entire harvest at 15,000 baht a tonne for white rice and 20,000 baht for fragrant or Hom Mali rice.

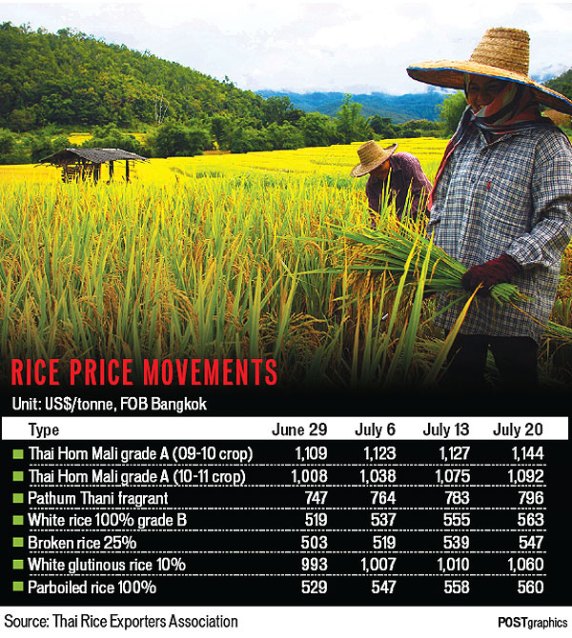

Even though the party has said purchases would not start until November, rice prices have been rising each week since before the July 3 general election (see table).

Thai rice prices, the benchmark for Asia, rose by 0.7% yesterday from a week earlier on optimism the new government will buy the grain at above-market rates, said the TREA after its weekly price-setting meeting.

It said the price of 100% grade-B white rice reached $567 a tonne, while 25% broken rice rose to $506 a tonne from $502 last week.

Vice-president Charoen Laothamatas said that if the mortgage programme returns, the free-on-board price of Hom Mali would reach US$1,400 a tonne, making it difficult to market.

“If Thai exporters cannot buy such expensive rice for export, they may opt for much cheaper rice from Vietnam, Cambodia or Burma, as they must maintain their market bases and customers. With the Asean free-trade agreement, such an alternative would be possible,” he said.

Some rice exporters and millers have already established trading firms or representative offices in Cambodia and Vietnam to purchase rice for export to foreign customers.

“We have to accept that Vietnam’s rice quality has improved a lot. Fragrant rice in Vietnam is $400 to $500 a tonne cheaper than Thai Hom Mali rice and $150 to $200 lower than Thai Pathum Thani rice,” said Mr Charoen.

He said competition from Vietnam had resulted in Thai Hom Mali’s share of traditional markets such as Hong Kong dropping to only 50% from 85% normally.

Thailand is also at disadvantage in terms of logistics, as the cost for shipping a 20-foot container to the US is $1,700 to $1,800 from Thailand but only $1,350 from Vietnam. Rice exports to China would be $220 more than the $100 cost of shipments from Vietnam.

Chookiat Ophaswongse, the TREA honorary president, predicts exports could be cut in half if the government has no measures to assist exporters.

That means export revenue losses of 60-70 billion baht based on this year’s expected 10 million tonnes.

“The government must have measures to support exporters such as offering the government’s stockpile at special price or open bidding for the stocks rather than asking only some exporters to offer prices,” he said.

TREA president Korbsook Iamsuri said that while exports should be able to meet this year’s target of 10 million tonnes, three areas of concern remain.

They are the government’s rice mortgage policy jacking up prices; the baht appreciating further, also making Thai rice more expensive; and India’s plan to export at least one million tonnes of rice from next month, as its price beats Thailand’s by $100 a tonne.

As well, India’s stockpile, normally about 20 million tonnes, is now unusually high at 60 million tonnes.

Thailand exported 6.3 million tonnes of rice in the first half of this year, up by 58.3% year-on-year.

No comments:

Post a Comment